NEW-TO-BANK ONBOARDING JOURNEY

Onboarding new to bank customers as the customers’ first experience with any bank should be the most pleasant; yet it is one of the most and tedious experiences in many banks in almost all the world’s geographies.

Great ideas require great tools. In Tiresias, we promote the blend of business experience with latest agile technology to produce solutions of Excellence in a DevOps mode which help banks do business efficiently at optimized cost of operations and in a manner that leaves a pleasant impact in the hearts and minds of the customers.

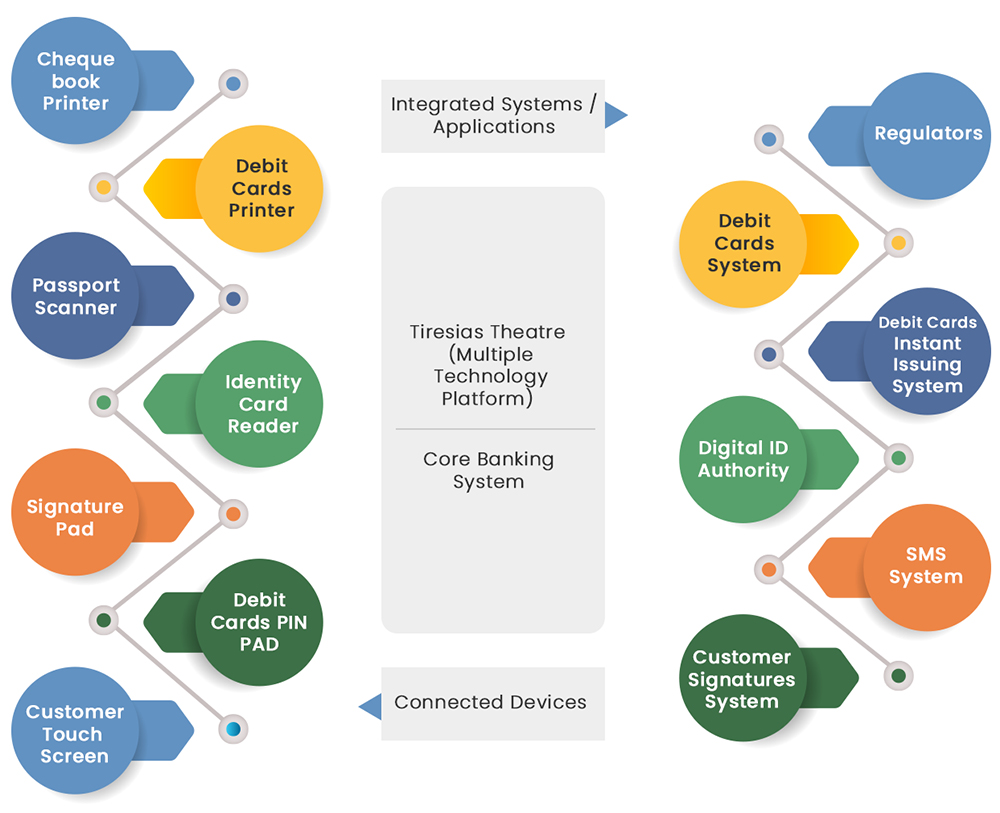

New-to-bank Onboarding Journey is built over the powerful Tiresias Theatre Technology Platforms (3TP) and inherits the entire technology functionalities of 3TP components many of them are unique capabilities that came as a result of the innovative technology techniques infused in Tiresias technology.

Pain Points

- No continuous KYC screening / review leading to Regulatory & Compliance breach

- Difficulty to report and attend Regulatory enquiries

- No verification mechanism to ensure the validity of Customers Identity

- Handwritten AOF difficult to decipher & manual data entry prone to errors

- Weak control to ensure original documents are sighted during onboarding

- Weak control to ensure the customer is physically presents while filling the AOF

- Multiple levels of data entry on many systems (duplicate) leading to longer TAT for E2E

- Discontinuous Operations

- Lack of communication between Business Stakeholder

- No proper system record for related parties like Guardians & Power of Attorney holders

Typical Onboarding Pains

- Weak controls to check the authenticity and validity of the KYC documents on the spot.

- Ineffective authentication of customer identity.

- No inherent workflow is available in application for easy tracking of status.

- More time is being spent on digitization of documents.

- Manual KYC assessment process may result in breach in terms of Compliance guidelines.

- Requiring manual actions to resolve identified discrepancies may result in more turnaround time.

- KYC screening requires manual input on the application and any error will impact the accuracy of the results.

- No facility in many of the existing systems to capture related parties’ detail (e.g. holder of power of attorney on accounts) which means weak KYC.

- No standardization for reference data such as occupations and line of business.

- Offline data residing on paper forms and applications.

- Discontinuous operations: fragmented processes and steps in the same process and multiple systems involved with different logins to achieve what customers expect in their first-time journey with the bank. An active account, a debit card, a cheque book, informational welcome pack and less waiting time and process time.

- Inflated cost of operations: inefficiency results by necessity in extra unit cost. Each minute comes with its own cost.

Tiresias NTB Onboarding Journey: pain points solved

- All Channels in full sync: Mobile, Web, Tablets and Branches in a synchronized manner.

- Totally paperless and 100% online data (nothing left on paper; system caters for each piece of information).

- Integrations with all underlying applications used in the process to ensure a delivery at minimal TAT and premier customer experience.

- A dynamic workflow to digitize the end-to-end process of Customer Onboarding & Account opening with adherence to Compliance and Regulatory guidelines, delivering accuracy and consistency with fully automated KYC capturing workflow.

- Significantly reduced TAT: in-branch TAT mean at 25 minutes and at 7 minutes on digital channels.

- Optimised Cost of operations: TAT reduced mean time, paperless, and automated controls contributes to significant reduction in the transaction cost.

- API rich: configurable integrations with internal systems, third parties and hardware of any type in unprecedented speed.

- Meaningful customer journey: customers receive full product delivery in fulfillment of their initial desire via multiple touchpoints.

- Standardize the customer data to match international benchmarks like ISO, ISIC & ISCO.

- Operations and Service Delivery real-time monitoring dashboards and alerts.

Integrations Diagram – All in one place and single sign on

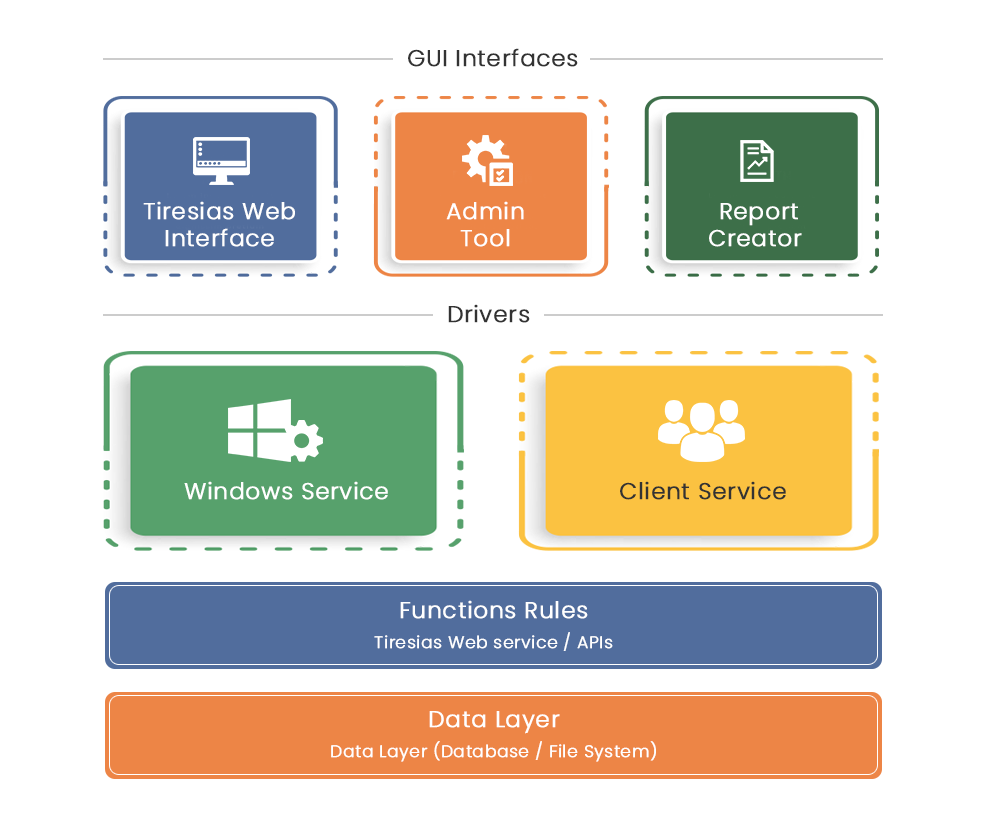

Product Architecture and Components